In Jharkhand you can pay Commercial Taxes and Government dues online by using the online ePayment Gateway of Jharkhand Commercial Tax Department. Taxes of VAT, CST, Advertisement Tax, Luxury Tax, Electricity Duty, Entertainment Tax, Professional Tax, Jharkhand Sales Tax can be paid with or without registering with the Web Portal. There is no need of visiting bank or Commercial Tax Department or any other Government Department to pay Commercial Taxes. After making online payment instant online receipts for payment made and instant online banks transaction number becomes available. payment of Personal taxes as well as behalf of the firm, company and others can be done through the system. The steps to Pay Commercial Taxes and government dues online in Jharkand are explained here:

Step 1: Visit the Website http://jharkhandcomtax.gov.in/e-payment

Step 2: Click on Un Registered

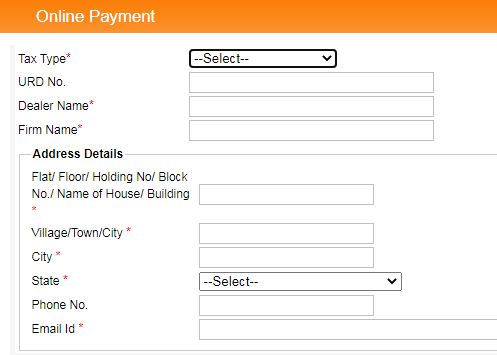

The following Menu will be displayed on the Screen

Step 3: Fill the information asked for

Tax Type : Select Tax Type from the List

URD No : If you have URD No fill it

Dealer Name : Fill Dealer Name

Firm Name : Type Firm Name

Address Details

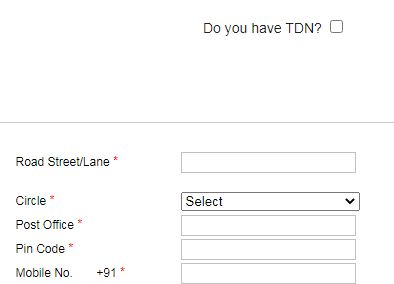

Fill Address

Select State and Circle from the List

Fill Mobile No and Email ID

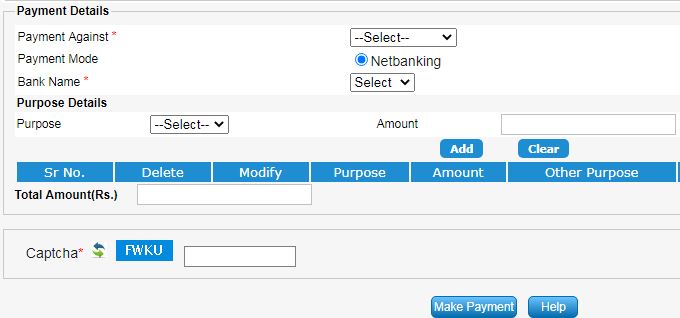

Payment Details

Payment Against : Select payment against order, Check post, Fees and Return

Step 4: Select Payment Mode

Step 5: Select Bank Name

Step 6: Select Purpose

Step 7: Fill Amount

Step 8: Enter Captcha code showing on the Screen

Step 9: Click on Make Payment

Step 10: Follow instructions and make payment

Step 11: Take Printout of online Receipt

Step 1: As explained above

Step 2: Click on Registered

Step 3: Fill the information asked for

Tax Type : Select Tax Type from the List

URD No : If you have URD No fill it

Dealer Name : Fill Dealer Name

Firm Name : Type Firm Name

Address Details

Fill Address

Fill Mobile No and Email ID

(Please leave the inactive fields)

Payment Details

Payment Against : Select payment against order, Check post, Fees and Return

Step 4: Select Payment Mode

Step 5: Select Bank Name

Step 6: Select Purpose

Step 7: Fill Amount

Step 8: Enter Captcha code showing on the Screen

Step 8: Click on Make Payment

Step 10: Follow instructions and make payment

Step 11: Take Printout of online Receipt

Disclaimer: Information given here is to guide and help those who do not have knowledge of using online facility to Pay Commercial Taxes online or use online facility to check status of payment etc. We are not responsible for any mistake or error or loss of amount to the user. Our website is only guiding how to use online payment facility. All payments are being done through the website of Government Department and you may contact respective department for grievances if any. This website is to provide free information to users and we do not charge any amount from any user. Trade marks and copy rights are of respective website owners.

AP Pay Commercial Taxes challan online

Assam pay taxes, Government dues online

Chhattisgarh Pay Commercial Tax online

Goa pay taxes online through epayment

Gujarat Pay Tax online through epayment

Jharkhand pay tax online Professional, VAT

Karnataka Entry Tax payment online

Karnataka Professional tax Payment online

Karnataka Entertainment tax payment online

Kerala Pay Commercial Tax online

MP ePayment of Tax through MP treasury

Odisha online payment of taxes

Punjab epayment of commercial tax

Rajasthan Pay Commercial taxes online

Telangana online Payment of Taxes