In Tamil Nadu you can pay Taxes online through the web portal of Commercial Taxes Department. You can pay Value Added Tax (VAT), Central Sales Tax (CST), Entertainment Tax for Park, Entertainment Tax for DTH, Entertainment Tax for Cricket, Entertainment Tax for Theater, Entertainment Tax for Television, Tamil Nadu Tax on Luxuries in Hotels and Lodging Houses Act, 1981, Tamil Nadu Betting Taxes Act 1935, Tamil Nadu Tax on Entry of Motor Vehicles into Local Areas Act 1990. The steps to Pay Commercial Tax online in Tamil Nadu are explained here:

Step 1: Visit the Website of Commercial Taxes Department Government of Tamil Nadu

The following Menu will open

Step 2: Select Type of tax from the List

Step 3: Click on Submit

The following Menu for Epayment of Tax will open

Step 4: Select Registered User and Fill Information

TIN : Type TIN

Branch :Select Branch

Address Details

In case of Registered user address will be displayed after entering TIN.

Payment Details

Payment Type : Select Payment Type from the List

Payment Mode : Select Net Banking

Bank Name : Select your Bank Name for payment

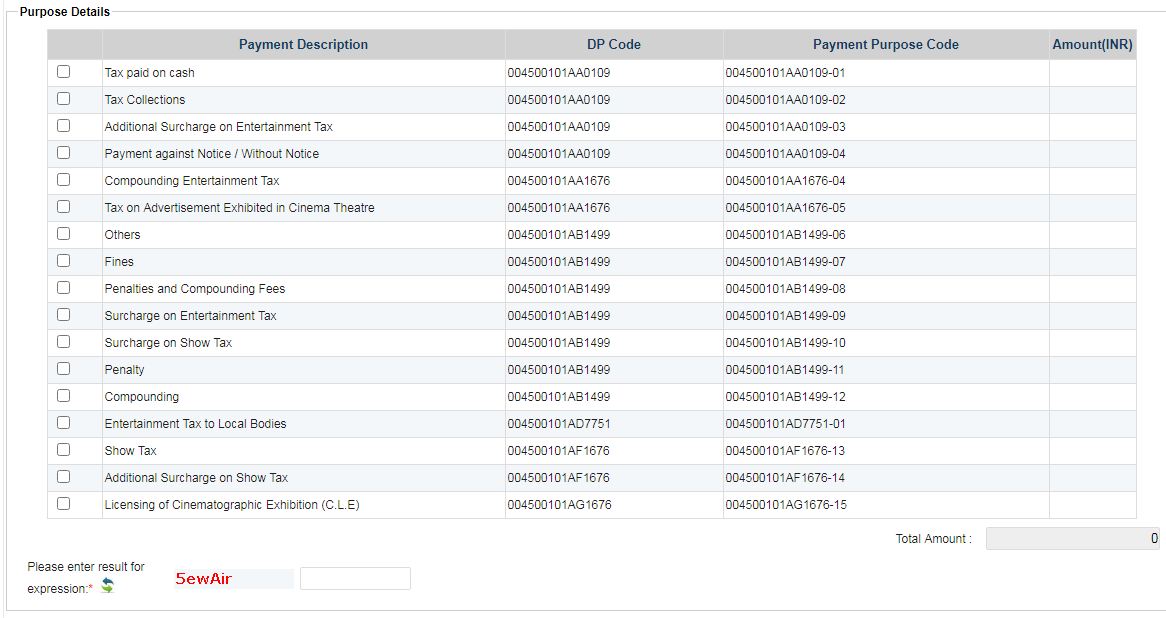

Purpose Details

Click on box at the left to select purpose

Amount : Fill amount of tax to be paid

Please enter result for expression : Enter Security Code

Click on the box of "I agree that the above details furnished are correct and complete"

Step 5: Click on Confirm

Step 6 : Click on Submit

Step 7: Follow instructions and Make payment of tax

Step 8: Take Printout of online Receipt or download it.

Step 4: Select Un Registered User and Fill Information

Payment Details

Payment Type : Select Payment Type from the List

Payment Mode : Select Net Banking

Bank Name : Select your Bank Name for payment

Purpose Details

Click on box at the left to select purpose

Amount : Fill amount of tax to be paid

Please enter result for expression : Enter Security Code

Click on the box of "I agree that the above details furnished are correct and complete"

Step 5: Click on Confirm

Step 6 : Click on Submit

Step 7: Follow instructions and Make payment of tax

Step 8: Take Printout of online Receipt or download it.

Disclaimer: Information given here is to guide and help those who do not have knowledge of using online facility to Pay Commercial Taxes online or use online facility to check status of payment etc. We are not responsible for any mistake or error or loss of amount to the user. Our website is only guiding how to use online payment facility. All payments are being done through the website of Government Department and you may contact respective department for grievances if any. This website is to provide free information to users and we do not charge any amount from any user. Trade marks and copy rights are of respective website owners.

AP Pay Commercial Taxes challan online

Assam pay taxes, Government dues online

Chhattisgarh Pay Commercial Tax online

Goa pay taxes online through epayment

Gujarat Pay Tax online through epayment

Jharkhand pay tax online Professional, VAT

Karnataka Entry Tax payment online

Karnataka Professional tax Payment online

Karnataka Entertainment tax payment online

Kerala Pay Commercial Tax online

MP ePayment of Tax through MP treasury

Odisha online payment of taxes

Punjab epayment of commercial tax

Rajasthan Pay Commercial taxes online

Telangana online Payment of Taxes