You can pay Income Tax online by using the online payment website portal of Income Tax Department. This facility can be used by all kinds of assessees like individuals, partnership firs, companies, trusts, societies, HUF etc. Guide and steps to pay Income Tax online are explained below:

Step 1: Visit the Website of Income Tax Department Tax Payment Section

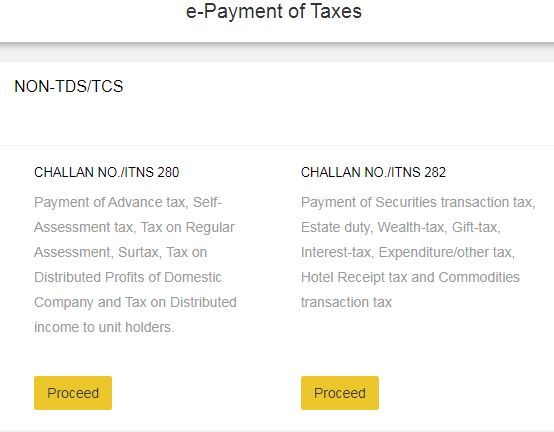

The following Menu will open

Step 2: Select Challan No/ ITNS 280

Step 3: Click on Proceed

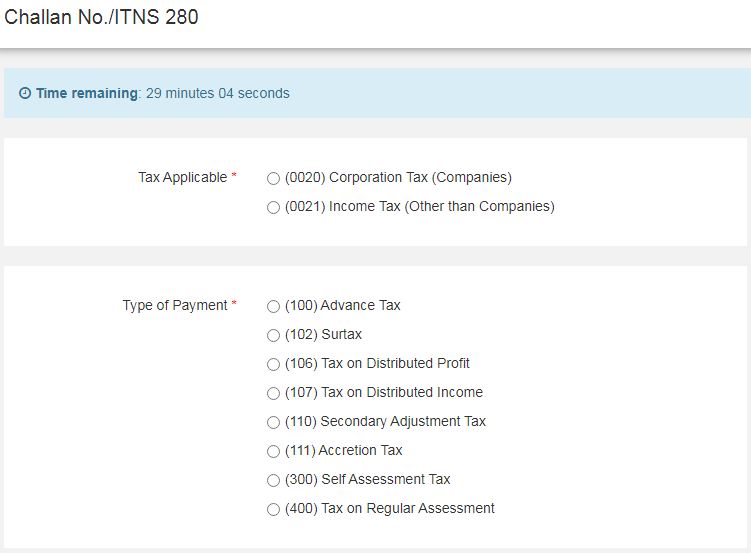

The following menu will open

Step 4: Fill Required information

Tax Applicable

- Select 0020 for Companies or

- Select 0021 for Individuals and other than Companies

Type of Payment

- Select 100 for Advance tax payment

- Select 300 for Self Assessment Tax (Before Assessment)

- Select 400 for Demand raised by Department

- Select other options if you are paying other taxes

Mode of Payment

- Select Net Banking and Bank name for online payment through bank

- Select Debit Card and Bank Name for payment through Debit Card

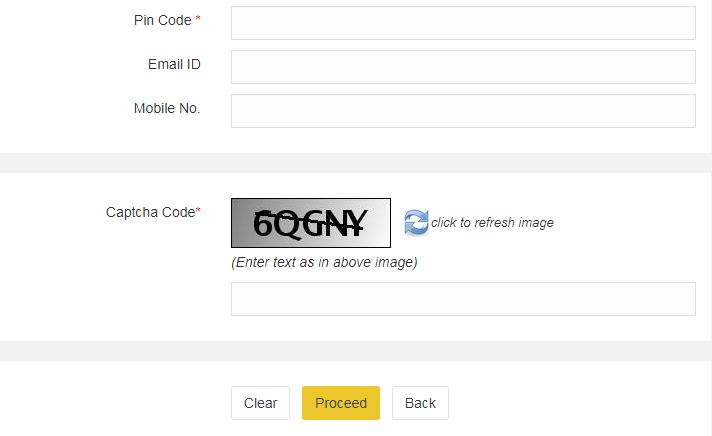

Permanent Account No: Fill your Income Tax PAN

Assessment Year: Select Assessment Year from the list

Address: Fill your Address

Email ID: Enter your email ID

Mobile No: Enter your Mobile Number

Step 5: Enter Security Code shown on the Screen

Step 6: Click on Proceed

Now Confirmation Menu will appear

Check the information entered. If there is any mistake you can edit it.

Step 7: Click on I Agree

Step 8: Click on Submit to the Bank

Now the Bank Login Menu or Debit Card Payment menu will appear

Step 9: Fill login information or debit card information and Proceed

Now the tax payment menu will appear with your other details

Step 10: Fill required information

Tax Amount : Enter Income Tax Amount

Surcharge : Enter Surcharge amount if applicable

Education Cess : Enter Education Cess amount

Interest : Enter interest amount if any

Penalty : Enter Penalty amount if any

Others : Enter the amount here if payment is related to any other head

Step 11: Click on Next, and Complete Payment Procedure

After Making Payment, challan for payment will be generated by the system.

Step 12: Download and take printout of challan

Please remember to download the challan as it is compulsory to enter challan No, BSR Code, Date of Payment and amount to file income Tax return.

Disclaimer: Information given here is to guide and help those want to know the procedure for online payment of Income Tax through bank and Debit Card. We are not responsible for any mistake or error. This is a website to provide free information and we do not charge any amount from any user. Trade marks and copy rights are of respective website owners.

Apply Aadhar Card online, Update data

Apply for Driving License online in India

Apply for PAN Card online, Check Status

Apply for Passport online, Check Status

Check Status Aadhar, PAN, FIR, ITR etc

Check your Voter ID Card Status online

Check consumer case status onlne

Check Complaint status online NCW

File Complaint online with (NHRC)

File RTI Application form online, Pay fee

File Petition online Supreme Court

FIR Register online and get copy