You can pay Goods and Services Tax online by using various online payment options available to pay GST. Options available to make payment of GST are through Net Banking, Debit or Credit Card, RTGS, Neft or payment online through bank. Guide and steps to pay GST online are explained below:

Step 1: Visit the Website of Goods and Services Tax

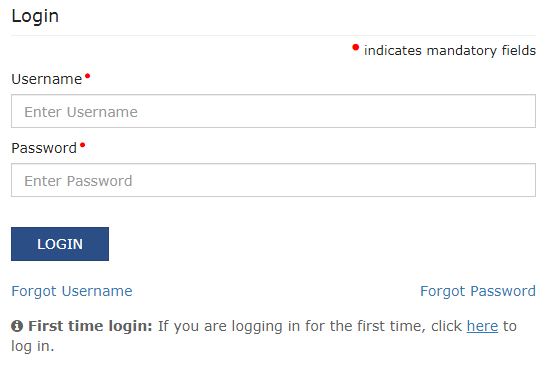

Step 2: Click on Login

The following menu will open

Step 3: Enter User Name and Password and click on Login

Now you are logged on to the website

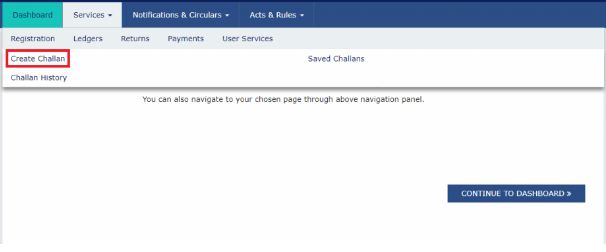

Step 4: Click on Services, then Payments

The following menu will appear

Step 5: Click on Create Challan

The following menu will appear

Step 6: Fill amounts in the columns

Step 7: Select payment method (E-payment, Over the Counter or Neft/ RTGS)

Step 8: Click on Generate Challan

Now a summary page will appear with all the details of challan.

Step 9: Click on MAKE PAYMENT after choosing the mode of payment

Step 10: Download and take printout of challan

After making payment you will receive a challan containing all the details of tax paid. Thereafter the tax paid challan (CIN) will be credited to the cash ledger account of the taxpayer.

I. There are 3 methods for payment of GST online:

1. Internet banking and debit or credit card

2. Payment in Bank counter through authorised banks

3. Payment through Neft / RTGS from any bank

There is a limit of Rs. 10000/- per challan for counter payment through banks

II. UN Bodies, embassies, government offices or other notified persons need to provide Unique Identification Number (UIN) to create a challan in before logging onto the GST portal.

III. ITax Return Preparers need to declare Tax Return Preparer Identification Number (TRPID)to create a Challan in pre-login.

IV. Unregistered dealer having temporary ID need to give their Temporary Identification Number (TMPID) to create a challan in pre-login.

Disclaimer: Information given here is to guide and help those who do not have knowledge of using online facility to pay GST online. We are not responsible for any mistake or error. This is a website to provide free information and we do not charge any amount from any user. Trade marks and copy rights are of respective website owners.

Zero GST Item List

0% GST Goods head 2716 to 9803

5% GST Item List

5% GST Items head 1001 to 1702

5% GST Items head 1801 to 2605

5% GST Items head 2606 to 5212

5% GST Items head 5301 to 9804

12% GST Item List

12% GST Goods head 0402 to 2801

12% GST Goods head 2847 to 4702

12% GST Goods head 4703 to 5809

12% GST Goods head 5810 to 8306

12% GST Goods head 8401 to 9405

12% GST Goods head 9503 to 9804

18% GST Rate Item List

18% GST Items head 1107 to 3302

18% GST Items head 3303 to 3801

18% GST Items head 3802 to 4201

18% GST Items head 4202 to 4819

18% GST Items head 4820 to 6801

18% GST Items head 6802 to 7020

18% GST Items head 7201 to 7419

18% GST Items head 7501 to 8309

18% GST Items head 8310 to 8459

18% GST Items head 8460 to 8539

18% GST Items head 8540 to 9029

18% GST Items head 9030 to 9802

GST Registration online www.gst.gov.in

How does GST Work and the benefits

Central, State level taxes absorbed GST

Registration Procedure and filing Return

GST E-way bill validity & documents

GST Registration online www.gst.gov.in

How does GST Work and the benefits

Central, State level taxes absorbed GST

Registration Procedure and filing Return

GST E-way bill validity & documents

The Central Goods and Services Tax (Amendment) Act, 2018

The Integrated Goods and Services Tax (Amendment) Act, 2018

The Union Territory Goods and Services Tax (Amendment) Act, 2018

Central Goods and Services Act 2017 (CGST Act 2017)